You should follow Suckaholic’s advice and invest in T-bills and pay 40.8% on your income

SBV collapse.

Moderator: Jesus H Christ

- Bill in Houston

- Eternal Scobode

- Posts: 1088

- Joined: Wed Jun 10, 2020 12:29 am

Re: SBV collapse.

Yes , the maximum Fed tax rate for long-term capital gains is 23.8%.

You should follow Suckaholic’s advice and invest in T-bills and pay 40.8% on your income

You should follow Suckaholic’s advice and invest in T-bills and pay 40.8% on your income

- Bill in Houston

- Eternal Scobode

- Posts: 1088

- Joined: Wed Jun 10, 2020 12:29 am

Re: SBV collapse.

Nominal vs. Real is surely years beyond Suckaholic’s education.mvscal wrote: ↑Tue Mar 14, 2023 2:57 pmEvidently, inflation seems to be hard to understand heresmackaholic wrote: ↑Tue Mar 14, 2023 10:20 am

Do you even understand the definition of risk?

A T-bill gives you a GUARANTEED return. And if I'm not mistaken, they are tax free.

So, yeah, right about now, a tax free 5% might be looking pretty good compared to putting your money at risk in say, something like SVB stock where it might vanish.

Risk/reward calculations change when it becomes risk/60% of reward.

What is so hard to understand here?

- Bill in Houston

- Eternal Scobode

- Posts: 1088

- Joined: Wed Jun 10, 2020 12:29 am

Re: SBV collapse.

I explained the maximum investment risk earlier. You can’t read. Not my problem.smackaholic wrote: ↑Tue Mar 14, 2023 10:20 amDo you even understand the definition of risk?Bill in Houston wrote: ↑Tue Mar 14, 2023 4:51 amI didn’t say all 401k money was in equities. Nice strawman attempt. Try reading what I said and address that, or not since you’re now spinning.smackaholic wrote: ↑Tue Mar 14, 2023 1:09 am

You think all 401K money is in equities?

Is that what you are going with?

Much is, but a fair bit isn't. Many of the uber rich who don't need big returns, stuff a lot of it in T bills. And with a 40% tax, those T bills look even better.

You’re now saying that T-bills are more attractive with a 40% tax rate? Wtf? Why?

A T-bill gives you a GUARANTEED return. And if I'm not mistaken, they are tax free.

So, yeah, right about now, a tax free 5% might be looking pretty good compared to putting your money at risk in say, something like SVB stock where it might vanish.

Risk/reward calculations change when it becomes risk/60% of reward.

What is so hard to understand here?

I also explained maximum return for equities. Tax rates don’t affect that.

If treasuries are guaranteed why did SVB fail? Only guaranteed at maturity.

You’re making it obvious that this entire subject is miles over your head. Go ahead and continue if you must.

Re: SBV collapse.

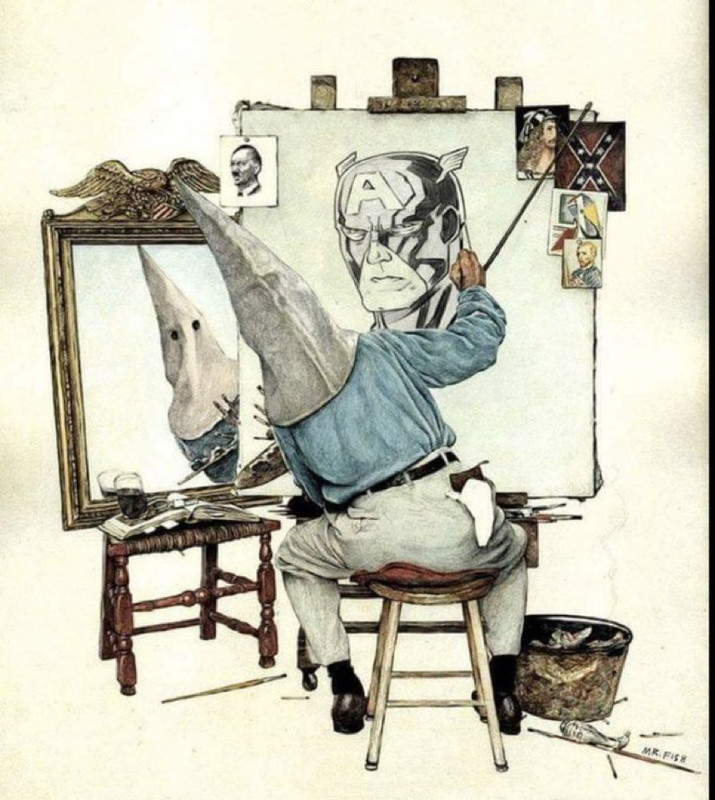

FTFY

Screw_Michigan wrote: ↑Fri Apr 05, 2019 4:39 pmUnlike you tards, I actually have functioning tastebuds and a refined pallet.

- Diego in Seattle

- Rouser Of Rabble

- Posts: 8943

- Joined: Sat Jan 15, 2005 1:39 pm

- Location: Duh

Re: SBV collapse.

These bank failures are all due to their boards being "woke."

Just look at who was on Signature Bank's board.

Just look at who was on Signature Bank's board.

9/27/22“Left Seater” wrote:So charges are around the corner?

Re: SBV collapse.

She left the board ten years ago, dipshit.

Jesus fucking Christ.

Jesus fucking Christ.

Screw_Michigan wrote: ↑Fri Apr 05, 2019 4:39 pmUnlike you tards, I actually have functioning tastebuds and a refined pallet.

-

Kierland

Re: SBV collapse.

Qtards sink bank with deregulation, blame the gays.

You know, personal responsibility.

You know, personal responsibility.

Re: SBV collapse.

So SVB has been sold ?...

First Citizens Bank will buy "all the deposits and loans" of Silicon Valley Bank, after it went bankrupt at the beginning of March, a US banking agency said Sunday.

The transaction covers $119 billion in deposits and $72 billion in assets, and "SVB's 17 branches will open as First Citizens" on Monday, the Federal Deposit Insurance Corporation said.

Depositors of SVB will "automatically become depositors of First Citizens Bank", added the FDIC, which will continue to insure deposits.

SVB -- the United States' 16th biggest bank by assets and a key lender to startups in the country since the 1980s -- collapsed after a sudden run on deposits, prompting regulators to seize control.

First Citizens Bank will buy "all the deposits and loans" of Silicon Valley Bank, after it went bankrupt at the beginning of March, a US banking agency said Sunday.

The transaction covers $119 billion in deposits and $72 billion in assets, and "SVB's 17 branches will open as First Citizens" on Monday, the Federal Deposit Insurance Corporation said.

Depositors of SVB will "automatically become depositors of First Citizens Bank", added the FDIC, which will continue to insure deposits.

SVB -- the United States' 16th biggest bank by assets and a key lender to startups in the country since the 1980s -- collapsed after a sudden run on deposits, prompting regulators to seize control.

Before God was, I am

-

Sven Golly

- Elwood

- Posts: 506

- Joined: Wed Sep 21, 2022 9:11 pm

Re: SBV collapse.

Let's hope First Citizens does a better job at picking people to manage their risk.

DIE does not work.

DIE does not work.

- Sudden Sam

- Official T1B Gigolo

- Posts: 2831

- Joined: Thu Dec 08, 2022 5:38 pm

Re: SBV collapse.

Sam Brinton could head up the revamped bank. He needs a job.

-

Kierland

Re: SBV collapse.

Only straight white guys need apply.Sven Golly wrote: ↑Mon Mar 27, 2023 3:06 pm Let's hope First Citizens does a better job at picking people to manage their risk.

DIE does not work.

Re: SBV collapse.

Sure, we thought only white guys applied...whatever..

https://twitter.com/i/status/1638544853242978304

https://twitter.com/i/status/1638544853242978304

Before God was, I am