Europe and Asia both falling hard today - US Stocks will open down Tuesday.

This may be a good thing - as enough sell pressure could trigger a capitulation rally.

The Stages of a Bear Market − − Denial, Concern, Capitulation

Fri, Jan 11 2008, 05:48 GMT

by Comstock Partners Team

Comstock Partners Inc.

Let’s put this market into perspective. Generally bear markets go through three psychological phases - denial, concern and capitulation. Most often, but not always, the market rallies between each phase. The denial phase is the initial significant downleg from the bull market high. During this phase the majority of investors are still in a bullish frame of mind, after seeing continuing profits in their account and having seen the market bounce back from prior corrections. They look upon the decline as merely another buying opportunity and think that stocks are now cheap. In addition the fundamentals during this phase are still perceived as positive and any negative news is downplayed. Following this phase the market usually rallies, but on weak breadth and lower volume.

Eventually the market tops out well below its previous high and starts a new downleg carrying it to lower lows. During this phase the fundamental news significantly worsens and investors realize that that a bear market is in force. This is the phase of concern. During this phase many investors sell, but others hang in, feeling that the bad news is discounted and that a bottom is near. At this point the market may rally again as many observers feel that the decline has ended and that a new bull market has begun. This rally, also characterized by weak breadth and low volume, subsequently fails and heads down. At this point the majority becomes exceedingly bearish and throws in the towel, fearful of further declines and the potential disappearance of their assets. This is the capitulation phase, when stocks are sold on fear and emotion rather than on rational analysis. It is at that point that the market is finally ready to make an important bottom.

Obviously the above description is a generalized outline based on history, and never takes place in exactly the same way. However, we think that it provides a rough framework of what to expect.

Currently, the market is somewhere between denial and concern. While a large number of observers have recently switched to the recession camp, surveys of economists as well as comments in the financial press and TV indicates that the consensus is still looking for a soft landing, followed by a quick recovery with new market highs by year-end. As we pointed out in our last two weekly comments, we think that we are either in a recession now or about to enter one very soon. Furthermore, since we last wrote, more evidence of weakness has emerged, including a weak employment report and disappointing December retail sales. Consumers are likely to remain under pressure as a result of a weakening labor market, a negligible savings rate, high gasoline and food prices, plunging mortgage equity withdrawals and the ongoing deteriorating credit situation. With consumer spending accounting for 70% of GDP, it seems that a recession is a high probability—and capital expenditures usually follow consumer spending by a quarter or two.

Moreover, the stresses in the economy are now spreading to credit card companies. Capital One missed its 2007 earnings estimate by 20% amid increasing defaults, and raised its reserves substantially. Today American Express lowered its 2008 outlook, citing slower spending and more missed payments on credit cards as a result of the housing weakness spreading to other sectors of the economy.

With the news continuing to worsen, it will not be long before a recession is universally acknowledged and market attitudes change to "concern" and eventually to "capitulation". While the Fed will undoubtedly cut rates significantly and the Administration will attempt to initiate stimulative measures, the recession and falling earnings estimates are likely to play out as they always do. While the downturn is likely to be interspersed with misleading rallies, at some point investors will capitulate and the market will bottom. At present, though, we believe the bear market is only in its early stages.

Constock believes we're only in the early stages of the Bear - they may be right.

The reactions to the first rally and any subsequent follow through days will tell if we are close to a bottom or if there's more pain ahead.

Tech sector will weigh heavily on the markets this week - MFST, AAPL, TXN, JAVA & MOT among others report.

As previously mentioned - last week IBM and AMD both were up and with respectable forward guidance

I suspect the techs will have decent reports and more important decent guidance.

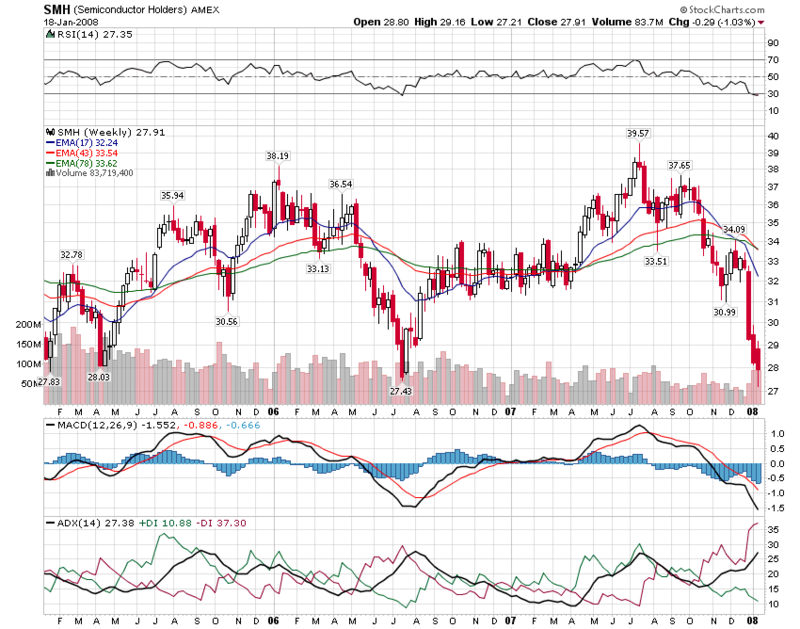

Almost all major market moves / recoveries begin in tech - the SMH is a very good barometer

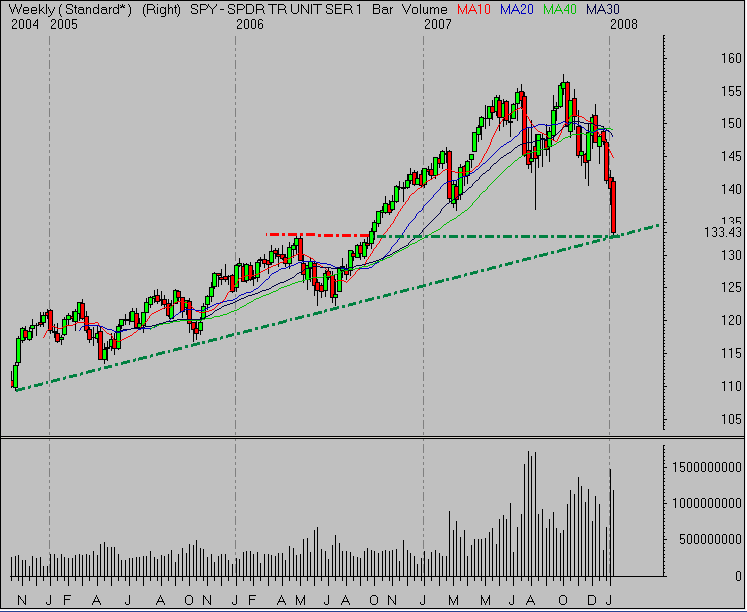

Last week the SMH briefly broke a 3 yr. low - but was subsequently bought bringing it back above the support line.

Should SMH close below 27.43 on the weekly, it's a decent indicator that we're not close to the bottom